Comprehensive Guide To Fifth Third Bank Log In: Secure Access And Essential Tips

In today's digital age, accessing your financial accounts online has become a necessity. Fifth Third Bank log in offers customers a secure and convenient way to manage their finances from anywhere in the world. Whether you're checking your balance, transferring funds, or paying bills, the online banking platform ensures ease of use and protection of your personal information. This article will provide a detailed guide on how to log in to your Fifth Third Bank account, explore its features, and offer tips for secure banking practices.

Fifth Third Bank is one of the leading financial institutions in the United States, offering a wide range of banking services to individuals and businesses. With its robust online banking system, the bank ensures that customers can access their accounts easily while maintaining the highest level of security. By understanding how to log in and use the platform effectively, you can take full advantage of the services provided by Fifth Third Bank.

This article will walk you through every step of the Fifth Third Bank log in process, including troubleshooting common issues and providing helpful tips to enhance your online banking experience. Whether you're a new user or a long-time customer, this guide will ensure you have all the information you need to make the most of your Fifth Third Bank account.

Read also:Eleanor Franchitti Net Worth A Comprehensive Look At The Wealth Of A Rising Star

Table of Contents

- Introduction to Fifth Third Bank

- How to Log In to Fifth Third Bank

- Features of Online Banking

- Security Measures

- Common Issues and Solutions

- Mobile Banking Options

- Tips for Secure Banking

- Frequently Asked Questions

- Benefits of Online Banking

- Conclusion

Introduction to Fifth Third Bank

Fifth Third Bank, headquartered in Cincinnati, Ohio, is a prominent financial institution serving customers across the United States. Established in 1858, the bank has grown into a leading provider of banking services, including personal and business banking, wealth management, and investment solutions.

History of Fifth Third Bank

The bank's history dates back to the 19th century, when it was founded as the Fifth Street Market House. Over the years, it has expanded its operations through mergers and acquisitions, becoming one of the top 10 U.S. banks by deposits. Fifth Third Bank is committed to delivering exceptional customer service and innovative financial solutions.

Core Services

Fifth Third Bank offers a wide array of services, including:

- Checking and savings accounts

- Mortgage and loan products

- Credit cards and debit cards

- Wealth management and investment services

- Business banking solutions

How to Log In to Fifth Third Bank

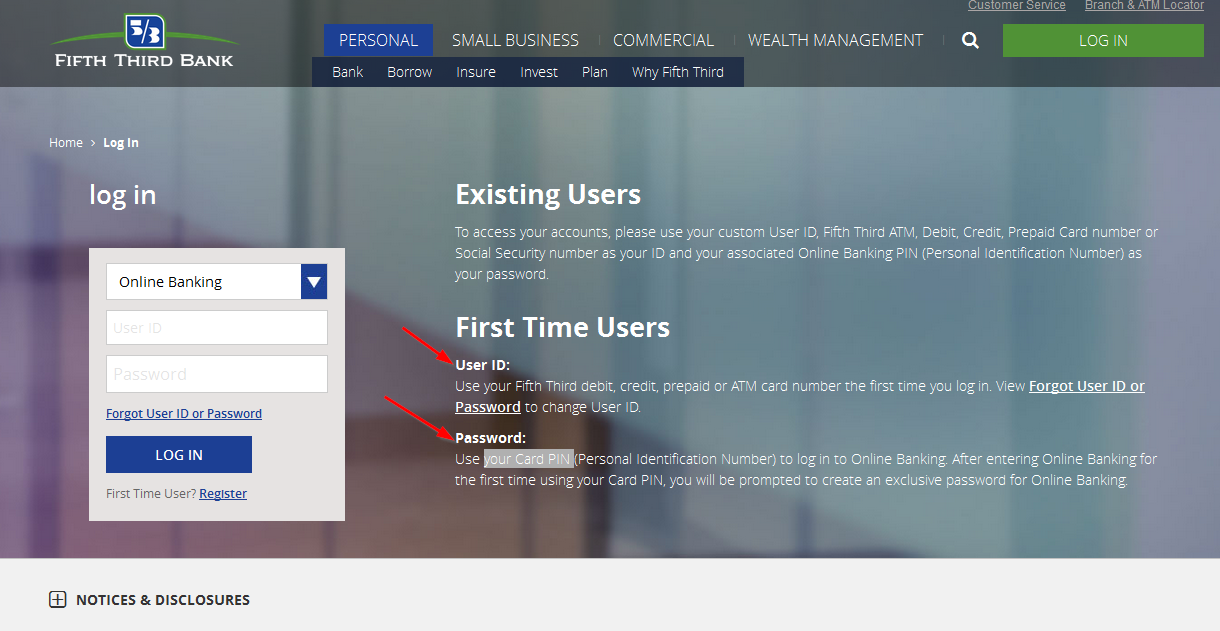

Accessing your Fifth Third Bank account online is a straightforward process. Follow these steps to log in securely:

Step-by-Step Guide

Step 1: Visit the official Fifth Third Bank website at www.53.com.

Step 2: Locate the "Log In" button on the homepage and click it.

Read also:Ronnie Coleman Body Fat Percentage Exploring The Science Behind The Legend

Step 3: Enter your username and password in the designated fields.

Step 4: Click "Sign In" to access your account.

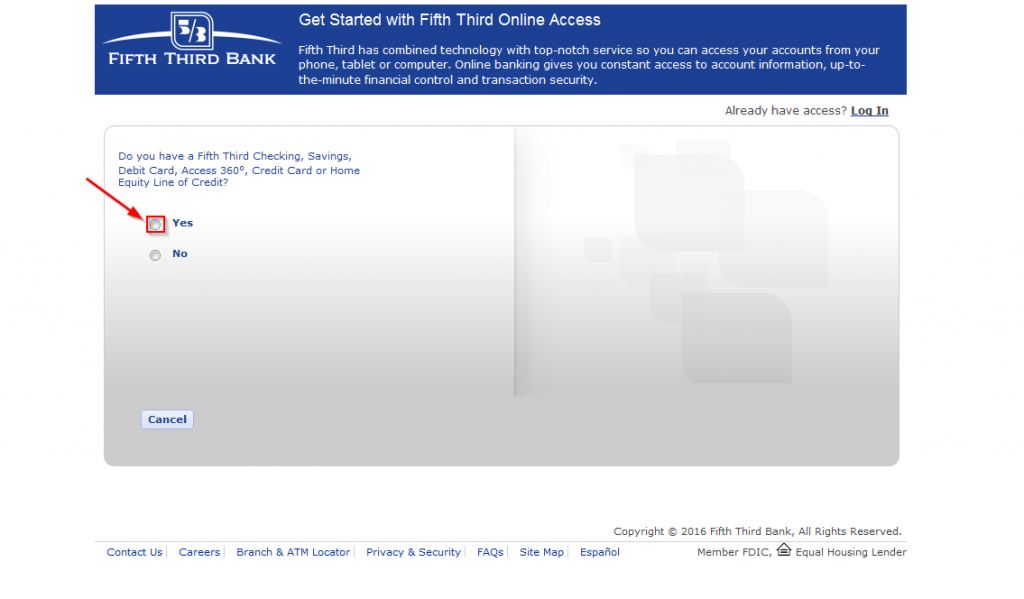

Enrolling in Online Banking

If you're a new customer, you'll need to enroll in Fifth Third Bank's online banking service. To do so:

- Visit the Fifth Third Bank website.

- Click on the "Enroll Now" button.

- Follow the prompts to create a username and password.

- Verify your identity using the information provided during account setup.

Features of Online Banking

Fifth Third Bank's online banking platform offers numerous features to help you manage your finances effectively. Some of the key features include:

Account Overview

View your account balances, transaction history, and account details in one convenient location. You can also set up alerts for account activity and low balances.

Bill Pay

Pay your bills online with ease. Set up one-time or recurring payments, and schedule payments in advance to avoid late fees.

Transfers

Transfer funds between your Fifth Third Bank accounts or to external accounts. You can also set up automatic transfers for savings goals or bill payments.

Security Measures

Fifth Third Bank prioritizes the security of your personal and financial information. Here are some of the security measures in place:

Two-Factor Authentication

Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

Encryption Technology

All data transmitted between your device and Fifth Third Bank's servers is encrypted to protect against unauthorized access.

Common Issues and Solutions

Occasionally, users may encounter issues when trying to log in to their Fifth Third Bank account. Below are some common problems and their solutions:

Forgotten Password

If you forget your password, click the "Forgot Password" link on the log-in page. Follow the prompts to reset your password using the security questions or email address associated with your account.

Account Lockout

If you enter your password incorrectly multiple times, your account may be temporarily locked for security reasons. Contact Fifth Third Bank customer service to unlock your account.

Mobile Banking Options

Fifth Third Bank offers a mobile app for iOS and Android devices, allowing you to access your accounts on the go. The app provides all the features of the online banking platform, including:

Mobile Deposits

Deposit checks remotely using your smartphone's camera. Simply take a photo of the check and submit it through the app.

Account Alerts

Receive notifications for account activity, low balances, and bill payments directly on your mobile device.

Tips for Secure Banking

To ensure the security of your Fifth Third Bank account, follow these best practices:

Strong Passwords

Create strong, unique passwords that include a mix of letters, numbers, and symbols. Avoid using easily guessed information like birthdays or pet names.

Regular Monitoring

Regularly review your account activity for any unauthorized transactions. Report any suspicious activity to Fifth Third Bank immediately.

Frequently Asked Questions

Q: Can I access my Fifth Third Bank account from anywhere?

A: Yes, you can access your account from anywhere with an internet connection by logging into the Fifth Third Bank website or using the mobile app.

Q: Is my information safe on the Fifth Third Bank platform?

A: Yes, Fifth Third Bank employs advanced security measures, including encryption and two-factor authentication, to protect your personal and financial information.

Benefits of Online Banking

Using Fifth Third Bank's online banking platform offers numerous advantages:

Convenience

Access your accounts 24/7 from anywhere in the world, eliminating the need to visit a branch.

Time-Saving

Perform banking tasks quickly and efficiently, such as paying bills, transferring funds, and monitoring account activity.

Conclusion

Fifth Third Bank log in provides customers with a secure and convenient way to manage their finances online. By following the steps outlined in this guide, you can easily access your account and take full advantage of the features offered by the bank's online platform. Remember to practice safe banking habits to protect your personal and financial information.

We encourage you to share this article with others who may benefit from it and leave a comment below if you have any questions or feedback. For more helpful guides and resources, explore our other articles on personal finance and banking solutions.

References:

- Fifth Third Bank Official Website

- Federal Deposit Insurance Corporation

- Consumer Financial Protection Bureau